As a bank, credit union, or financial services company, is your locator page doing everything possible to serve your customers and build your business?

This is a question worth looking into.

The right locator solution can make a big difference in terms of your customer recruitment efforts, and can end up boosting your bottom line. It can also help build a sense of trust in your institution.

According to research from Insider Intelligence, about 39% of consumers who are more trusting of digital solutions said they would open their next account with their current bank, versus only 21% of consumers with lower “digital trust” levels. Earning goodwill with consumers through tech that meets their needs, like a great locator solution, can only help your bank or financial firm solidify its place in the market.

Let’s look into the #1 ATM and bank branch locator solution available, Bullseye Locations, and several ways in which implementing it will help your business overall.

Why Banks and Financial Services Companies Need a Great Locator

When your customers need to find the nearest location to withdraw cash, make a deposit, review their loan eligibility, or meet with an agent, they want to find the right place to go in a snap.

By providing that for them, as well as giving them key information they’ll need before they pay your local branch or ATM a visit, you’re doing them an invaluable service.

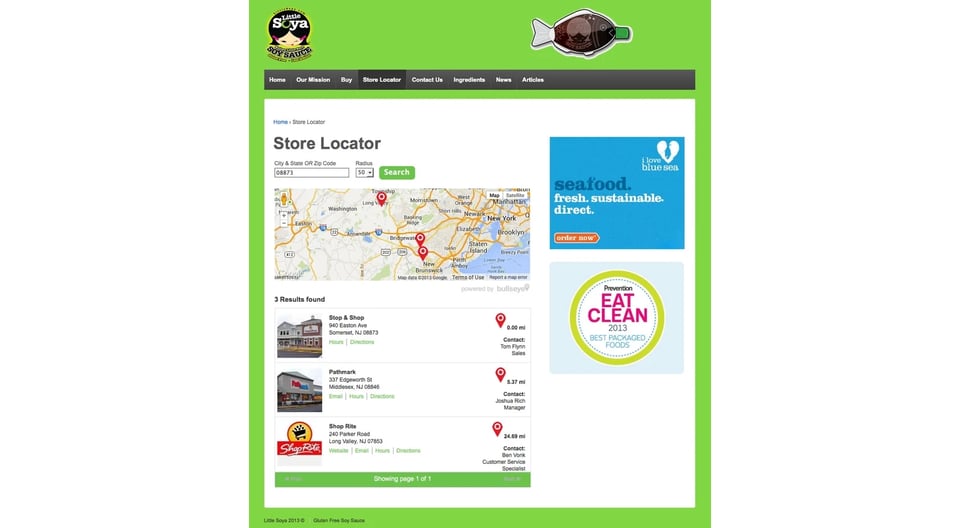

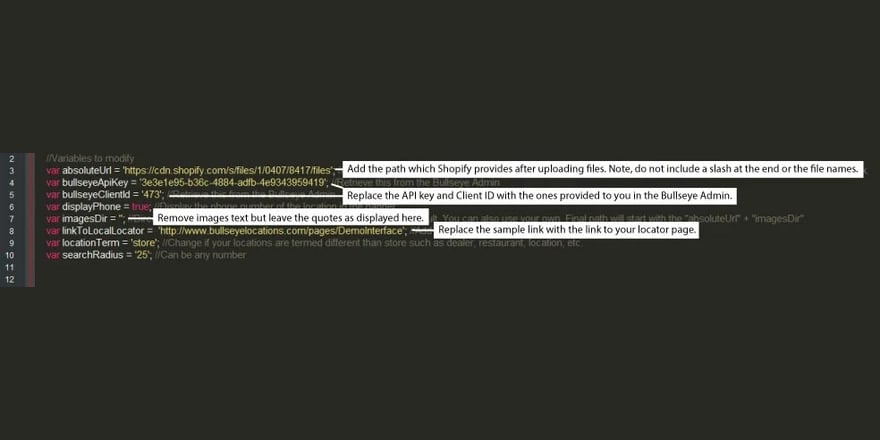

Bullseye is an enterprise-level software that creates easy-to-use location search pages. It’s aptly suited to help consumers find ATMs, bank branches, and other types of local outlets a bank or financial services company may have.

In short, Bullseye’s powerful features give you:

- The ability to create beautiful, on-brand, functional ATM and branch location pages, complete with dynamic Google Maps or Apple Maps that instantly show users where to go.

- The means to provide a valuable, 24/7 digital service that customers need.

- A way to actually build your core business and extend your brand’s reach.

When consumers need a bank branch or ATM, store locator software can point the way. It has to be the right platform, however.

Here are 4 important reasons to consider Bullseye:

1. Search Filtering for Different Financial Services

Modern consumers will approach your location search page online with their needs already top-of-mind.

If they need to open a new savings account, apply for a line of credit, or find a location where they can dispute a transaction, the local branches and offices that offer those exact services should be as few clicks away as possible. That’s why advanced search filtering features are key in a locator solution.

Bullseye allows you to display products and services available at each branch or local office, right within the search listings. Intuitive search filters are available from a drop-down menu, or by clicking boxes on your locator page.

In a Fractal survey of more than 3 million customer interactions with banks, friction in using online banking services was responsible for 70% of abandoned customer journeys. With a locator solution like Bullseye that provides easy-to-use search filter functionality, you’ll spare your customers from making calls and doing “homework” to get answers — while leading them to the only locations that offer what they need.

2. Dynamic Creation of SEO Landing Pages for Each ATM or Branch

Today’s consumer market for banking is extremely competitive. A major part of your advantage in acquiring new business may be how prominently your brand turns up in online searches.

This is where SEO content comes in. You’ll want webpages that provide more information about each of your ATMs, branches, field offices, or whichever other types of outlet your business has. These pages should appeal to both human readers and search engines.

The good news: Bullseye can create hundreds of pages like this for your brand automatically. Not only that: it allows you to link to these pages in your location search results.

With this feature, you can easily give your customers extra context on each location, its personnel, details about the services offered, and much more. Doing this can build an essential sense of consistency and trust in your brand.

3. Automatic Detection of User Location

When it comes to banking, customers don’t want to waste a second. You can safely assume they want to find the closest ATM or bank branch without delay.

According to studies by Signicat, abandonment rates for financial service applications have increased from 40% in 2016 to 68% in 2022, largely because the online experience is too time-consuming. Competitive banks and financial firms should drastically reduce how long it takes for consumers to get business done online.

Your brand can take a huge step here by providing automatic geolocation detection.

By instantly detecting your web users’ location, your website can show them where the nearest ATM, branch, or office is in a matter of seconds. Bullseye comes with this capability already built in.

This will have your customers making transactions, filing applications, or purchasing services in the blink of an eye — virtually eliminating the chance they’ll get distracted enough to check out a competitor.

4. The Ability to Generate New Leads From Customer Inquiries

Is your online presence working for your business? Research by Blue Fountain Media shows that more than 50% of banks either don’t measure online ROI at all or only do so for about 25% of their campaigns.

The growth of your company — and the return on your investment in digital tools for reaching out to customers — is directly tied to your ability to generate leads.

Fortunately, Bullseye’s ATM and branch locator solution lets you capture the information of high-intent customers as they’re looking for ways to engage your services.

With Bullseye, you can allow customers to request more info about a location via a popup form. Once they leave their name and contact information, you have a prime opportunity to follow up with them. This is a robust, repeatable process that can earn your brand lots more business over time.

Another thing to keep in mind: Bullseye is head-and-shoulders above other locator platforms in providing this lead gen capability, as it also integrates seamlessly with popular CRM and email marketing solutions that enable you to supervise customer journeys from start to finish.

When Your Customers Need the Right Branch or ATM, Only One Store Locator Software Fits the Bill

Consumers today have little patience for online experiences that fail to work or take too long, especially when it comes to managing their personal finances.

They’re expecting a personalized, thoughtful experience that’s accessible 24/7, whether they’re using a mobile phone or sitting at their desktop.

They’re looking for fast onboarding, no matter how in-depth the consultation will be…whether it’s to apply for a loan or make an appointment with a wealth management advisor.

Only the best locator solution will do. As the premier ATM store locator solution, Bullseye can be seamlessly woven into your web presence. You’ll be able to point users to the right ATM or branch instantly — while subtly communicating the fact that your brand should be trusted for all their financial service needs.

Ready to create a better location search experience for your brand? Schedule a free assessment of your current locator solution and see the Bullseye difference for yourself.